Our Chapter 13 Bankruptcy Lawyer Tulsa Diaries

Table of ContentsNot known Details About Chapter 13 Bankruptcy Lawyer Tulsa Facts About Best Bankruptcy Attorney Tulsa RevealedWhat Does Bankruptcy Lawyer Tulsa Mean?The Buzz on Tulsa Bankruptcy AttorneyWhat Does Tulsa Debt Relief Attorney Mean?

The stats for the various other primary kind, Chapter 13, are even worse for pro se filers. Suffice it to state, talk with a legal representative or two near you who's experienced with insolvency regulation.Numerous lawyers likewise provide free appointments or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is certainly the best choice for your scenario and whether they believe you'll certify.

Advertisement Now that you've made a decision personal bankruptcy is undoubtedly the right training course of action and you hopefully cleared it with an attorney you'll need to get begun on the documentation. Before you dive right into all the main insolvency types, you must get your own records in order.

Some Of Tulsa Bankruptcy Lawyer

Later down the line, you'll really require to confirm that by divulging all type of information concerning your financial affairs. Here's a standard checklist of what you'll need when driving ahead: Determining records like your chauffeur's license and Social Protection card Income tax return (up to the previous 4 years) Evidence of earnings (pay stubs, W-2s, freelance incomes, earnings from properties in addition to any type of income from government advantages) Bank declarations and/or retirement account declarations Proof of worth of your properties, such as automobile and genuine estate valuation.

You'll want to comprehend what type of financial debt you're attempting to deal with.

You'll want to comprehend what type of financial debt you're attempting to deal with.If your earnings is expensive, you have an additional option: Phase 13. This alternative takes longer to settle your financial obligations because it requires a lasting payment strategy normally three to five years before a few of your remaining financial debts are cleaned away. The filing process is likewise a great deal much more complex than Chapter 7.

The Greatest Guide To Experienced Bankruptcy Lawyer Tulsa

A Phase 7 personal bankruptcy stays on your credit scores report for one decade, whereas a Phase 13 insolvency drops off after 7. Both have enduring effect on your credit rating, and any type of brand-new debt you secure will likely include higher rates of interest. Before you submit your insolvency types, you must initially finish a required course from a debt therapy firm that has been accepted by the Division of Justice (with the notable exemption of filers in Alabama or North Carolina).

The course can be completed online, personally or over the phone. Programs commonly set you back between $15 and $50. You need to complete the training course within 180 days of declare bankruptcy (Tulsa bankruptcy lawyer). Use the Division of Justice's internet site to find a program. If you reside in Alabama or North Carolina, you must pick and complete a training course from a list of separately approved companies in your state.

The 2-Minute Rule for Bankruptcy Law Firm Tulsa Ok

Examine that you're submitting with the correct one based on where you live. If your irreversible home has actually moved within 180 days of loading, you ought to submit in the district where you lived the better part of that 180-day duration.

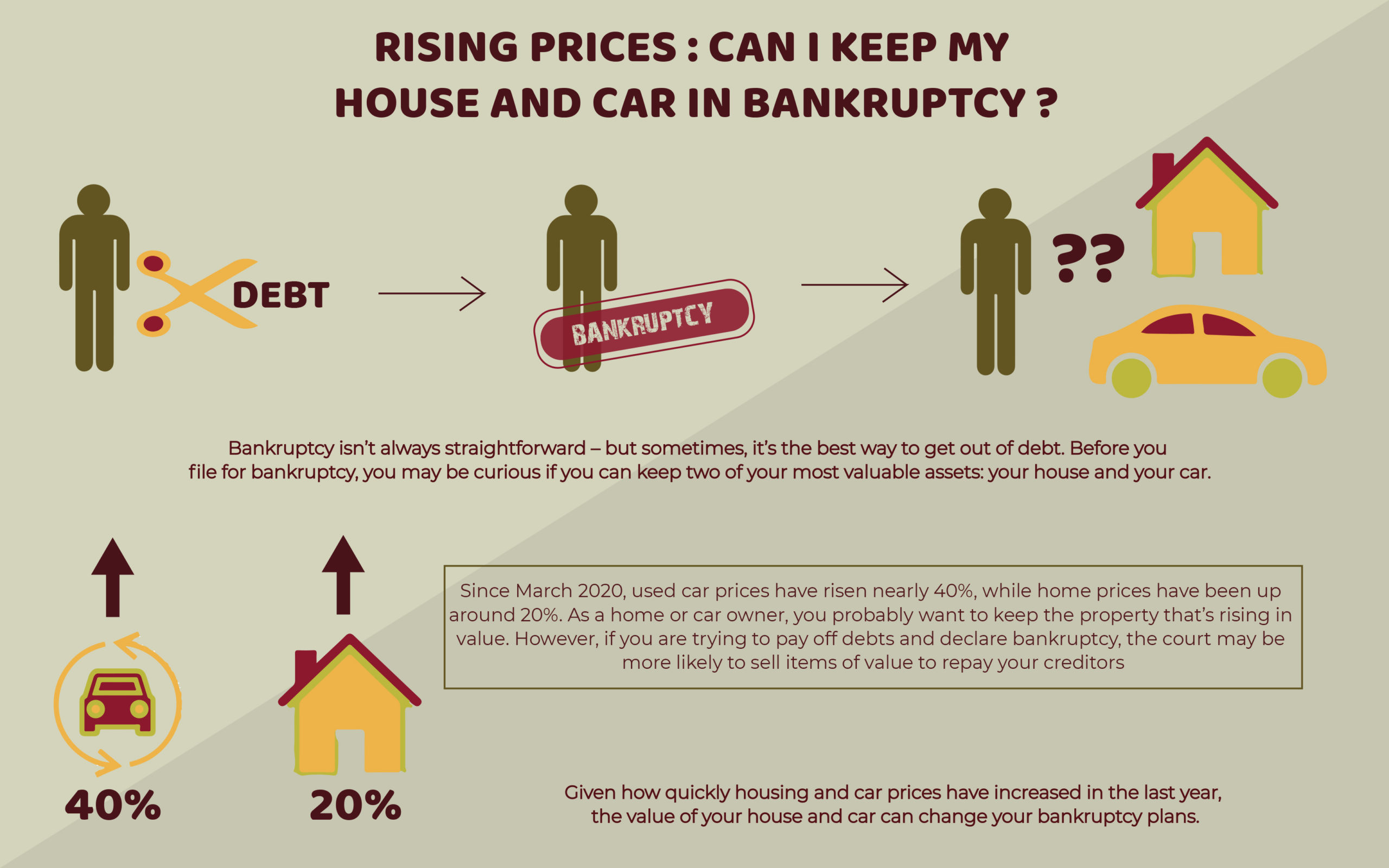

Typically, your personal bankruptcy lawyer will work with the trustee, yet you might need to send the individual files such as pay stubs, tax returns, and financial institution account and credit rating card declarations straight. An usual misunderstanding with bankruptcy is that as soon as you submit, you can quit paying your financial obligations. While bankruptcy can assist you wipe out numerous of your unprotected financial debts, Tulsa bankruptcy lawyer such as past due medical expenses or individual loans, you'll want to keep paying your regular monthly settlements for secured debts if you want to keep the building.

The Facts About Tulsa Bankruptcy Filing Assistance Revealed

If you're at danger of repossession and have worn down all my link various other financial-relief alternatives, then applying for Chapter 13 might postpone the repossession and conserve your home. Ultimately, you will certainly still need the income to continue making future mortgage repayments, as well as paying off any late payments over the course of your payment plan.

The audit could delay any type of financial debt alleviation by several weeks. That you made it this far in the procedure is a respectable indicator at the very least some of your financial obligations are eligible for discharge.